Housing market predictions for 2023

Mortgage rates remain high, home sales — and in some areas, home prices as well — are hitting the brakes, and uncertainty is permeating the market. It’s no wonder many homeowners, prospective sellers and hopeful buyers are feeling nervous.

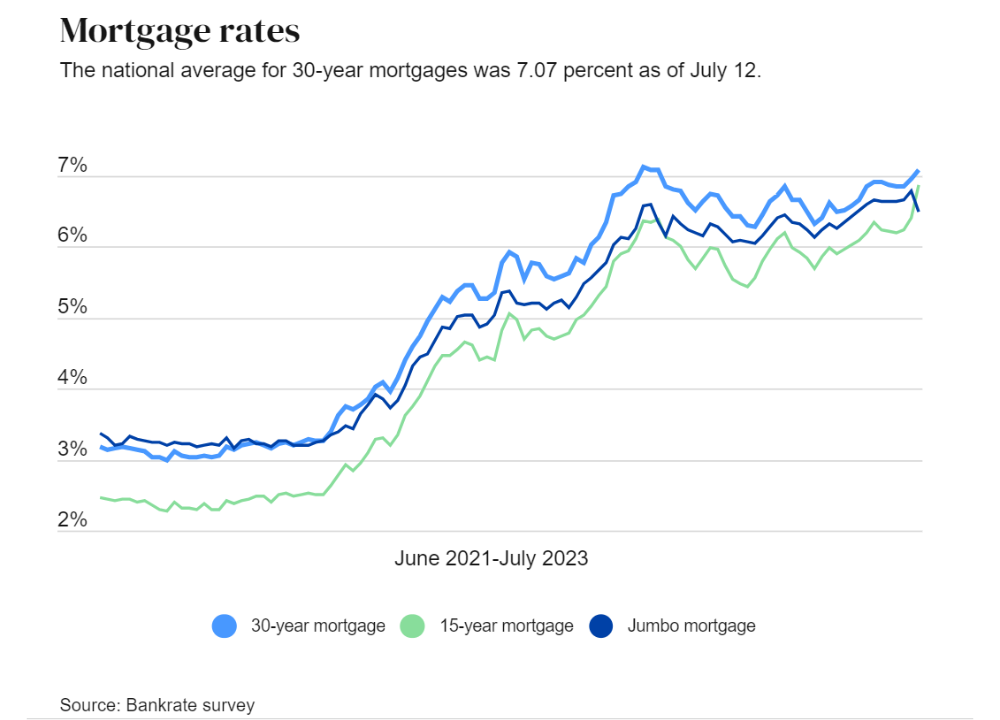

As of July 5, the average 30-year fixed mortgage rate was once again flirting with 7 percent (6.95 percent to be exact, according to Bankrate’s survey of large lenders). The Federal Reserve raised rates for 10 meetings in a row in an effort to curb inflation, before taking a pause at its recent June meeting. And sales of previously owned homes are down more than 20 percent since last spring, according to the National Association of Realtors’ most recent existing-home sales report.

Industry experts have varying forecasts and projections about where mortgage rates, home prices, buyer competition, housing supply, sales activity and home affordability are headed over the course of the rest of the year. Curious what the pros think? Read on for their 2023 housing market predictions.

Will mortgage rates continue to climb?

Interest rates roughly doubled in 2022, and mortgage rates followed suit. But how about across 2023? Will the cost of financing a home be coming down this year?

Some say no — and in fact think rates will climb much higher. “Continued inflation, overall higher interest rates, a potential recession and geopolitical tensions will force 30-year and 15-year mortgage rates up throughout 2023, and will bring the two rates closer together as short-term risks rise,” says Dennis Shirshikov of real estate website Awning. He foresees the 30-year and 15-year benchmark mortgage loans averaging 8.75 percent and 8.25 percent, respectively, across 2023.

Robert Johnson, a professor of finance at Creighton University’s Heider College of Business, shares some of those sentiments. “By the end of 2023, financial market participants expect that the Fed will have increased the target Fed funds rate by 175 to 200 basis points from current levels,” Johnson says. “That would translate into 30-year and 15-year mortgage rates at roughly 8.50 and 7.70 percent.”

Some experts are more hopeful, though. Rick Sharga, founder and CEO of real estate consulting firm CJ Patrick Company, expects rates to peak at about 8 percent and 7.25 percent for 30-year and 15-year loans in early 2023, “then gradually come down over the course of the year somewhat, to hang in the range of 6.0 percent and 5.25 percent, respectively,” he says.

Sharga does specify one caveat: “This is entirely dependent on the Federal Reserve’s ability to get inflation under control and ease up on its aggressive rate increases.” The Fed did in fact opt not to hike rates any further in its June meeting, but that is likely to be just a temporary reprieve, not necessarily an end to the hikes.

Three possible scenarios

Nadia Evangelou, senior economist and director of real estate research for the National Association of Realtors (NAR), lays out three potential rate scenarios for the rest of 2023, depending on the Fed’s moves going forward:

- “In scenario 1, inflation continues to remain high, forcing the Fed to raise interest rates repeatedly,” she says. “That means mortgage rates will keep climbing, possibly near 8.5 percent.”

- “In scenario 2, the Consumer Price Index responds more to the Fed’s rate hikes, and there is a gradual deceleration of inflation, causing mortgage rates to stabilize near 7 percent to 7.5 percent for 2023.”

- “Or, in scenario 3, the Fed raises rates repeatedly to curb inflation and the economy falls into a recession. This could cause rates to likely drop to 5 percent,” she says.

Will housing sales decline?

Each of Evangelou’s three scenarios would have a major impact on home sales. In each case, sales will be down — it’s just a question of how much. “Higher rates under scenario 1 could cause home sales to drop by more than 10 percent next year,” she says. “In scenario 2, home sales drop by 7 percent to 8 percent. And in the third, home activity may drop further, by more than 15 percent.”

Sharga agrees that the slowdown in home sales that beset the second half of 2022 will continue into 2023. In addition, he says, listings will continue to sit on the market for a longer time before selling. “Days on the market have been climbing back toward more normal levels recently, and we could see them approach 30 days or more in 2023 as the market continues to cool down,” he says.

However, the national average days on market has actually been getting shorter, not longer, of late. As of May it was just 18 days, according to NAR data, an improvement over 22 days in April, 29 days in March and a whopping 34 days in February.

Will home prices go down?

Will homes remain financially out of reach for many purchasers next year? Experts say hopeful buyers should not expect today’s high prices to plummet anytime soon. “Home prices won’t drop in 2023,” Evangelou says. “I expect pricing to be relatively flat.”

Prices will remain fairly steady — and in a lot of markets, that’s a price that is 40 percent or more higher than pre-pandemic.

— GREG MCBRIDE, BANKRATE CHIEF FINANCIAL ANALYST

“If inflation pressures ease and we see a meaningful pullback in mortgage rates, this will ease some of the strain on buyers — but only a bit,” McBride says.

“Overall home affordability won’t change dramatically,” Johnson agrees.

“Home prices will not fall proportionally,” Shirshikov says. “Any fall in prices will not be enough to offset the rising interest rate and its contribution to the monthly [mortgage] payment.”

Even slightly lower prices would still be welcome news for house-hunters, though. “There are plenty of potential buyers still patiently waiting to enter the market,” says Scott Krinsky, a partner in the residential banking department with Manhattan law firm Romer Debbas. “Assuming home prices ease, you’ll start to see some of these buyers emerge.”

So far this year, the markets seeing the steepest price declines are the same ones that were previously the most over-inflated. According to a recent Redfin study, the markets that saw double-digit declines included former hotspots like Austin (down 17.8 percent year-over-year), Oakland (down 16.3 percent), San Francisco (down 13.1 percent) and Las Vegas (down 11.4 percent).

Will housing inventory increase?

A shortage of available homes helped fuel the frenzied market of the last few years. But experts differ on housing inventory projections for 2023.

“Before the housing crash of 2008, inventory peaked at about a 13-month supply — twice what we would see in a healthy market,” Sharga says. “Today, we have about a three-month supply, which is about half of what we need. Current homeowners are unlikely to trade in their 3 percent mortgage for a new home with a 7 percent loan unless they absolutely have to, so existing home inventory should remain low. And we are not likely to see a huge boost in supply from new construction anytime soon, either.”

Others foresee increased supply, at least slightly. “Many reluctant sellers — those waiting for the market to turn around — will likely capitulate [this year], adding to more housing supply,” Johnson says.

“Housing inventory will rise throughout 2023 as homes become more unaffordable due to high rates,” adds Shirshikov.

According to the National Association of Home Builders (NAHB), new-build homes are in fact on the rise, which could help ease the existing-home shortage. May saw 1.63 million single-family housing starts, according to its data, which represents an 11-month high. “Single-family permits and starts increased in May as builders boosted production to meet unmet demand,” said NAHB chairman Alicia Huey in a June statement.

Will 2023 be a buyer’s market or a seller’s market?

For around two years, the country was in a clear seller’s market. But lately, buyers have been gaining back some leverage in many markets. So will the rest of 2023 favor buyers or sellers more?

“Affordability issues and economic worries will depress home buyer demand, and inventory of homes available for sale will remain limited,” says McBride. “So it’ll continue to be more of a balanced market than tilting one way or the other.”

Krinsky expects leverage to vary nationally, depending on the type of market. “With the pandemic, we saw a new spike of bidding wars in suburban and smaller markets, likely because of the desire for more space and the increased flexibility of remote working across the country,” he says. “Now that many offices and businesses are back near full capacity, the hope is that larger markets can revert back toward pre-pandemic levels and we will see increased demand there.”

Bottom line on the 2023 housing market

Most experts are in consensus that, in the big picture, 2023 will be a transitional year characterized by uncertainty.

“The housing market will be tepid in 2023, with only lukewarm demand and a limited amount of inventory available for sale,” McBride predicts. However, “mortgage rates could pull back meaningfully if inflation pressures ease.”

“The hope is that, as supply and demand within the housing market normalizes, interest rates can start to come back down to earth,” Krinsky says. “Until this happens, those who simply cannot afford the costs of borrowed money will have to continue to wait.”

But if mortgage rates don’t move much, “borrowers will pursue fewer purchase loans and we will see a continuing decline in rate-based refinance activity,” Sharga points out. “With more homeowners staying in place, we also might see an uptick in home equity loans and home equity lines of credit over the course of the year.” If moving is out in 2023, remodeling may well be in.