America’s Hottest Housing Markets Have a Newcomer So Cheap, Homebuyers Will Weep for Joy

By: Kimberly Dawn Neumann | REALTOR.COM

Although high mortgage rates have plunged most of America’s housing markets into early hibernation, if you zoom in closer, you’ll find that certain areas are busier and more bustling than a Black Friday doorbuster.

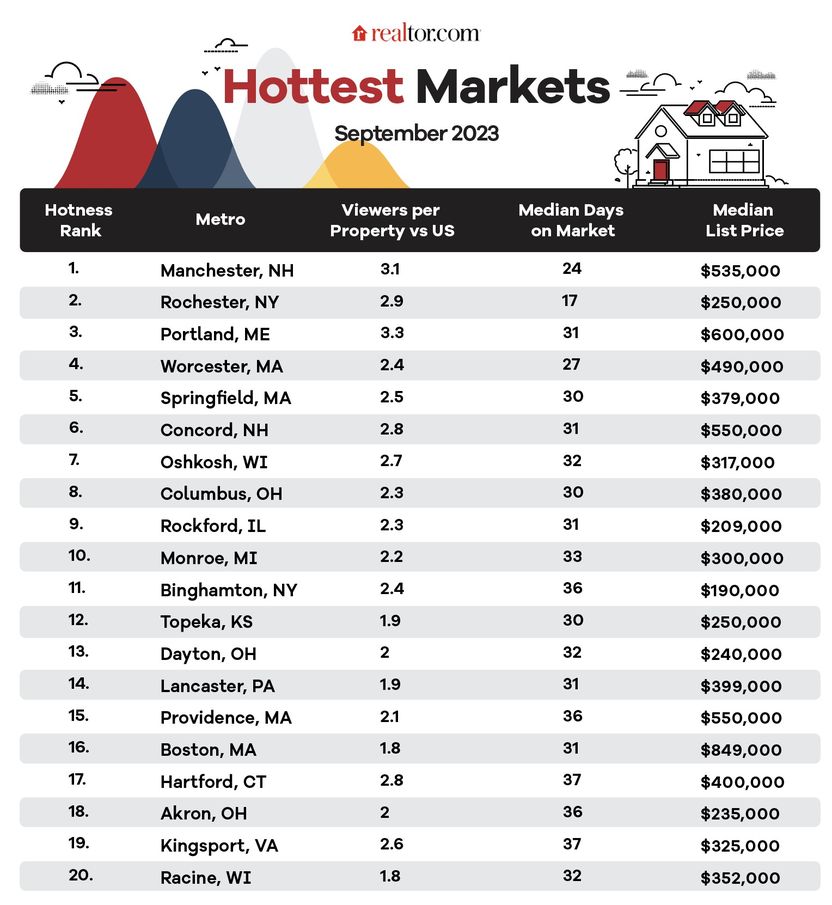

These were the findings of a new report by Realtor.com® of America’s Hottest Housing Markets, which gauges “hotness” via the number of views per listing and how long properties remain for sale.

Despite mortgage rates reaching a recent 23-year high and approaching 8%, homes in the 20 hottest markets in September had no shortage of interest and offers.

“These markets are seeing homes for sale move up to 31 days more quickly than the typical property in the United States,” says Realtor economist Hannah Jones in her analysis.

Where America’s hottest housing markets are hiding today

According to September data, 11 of America’s 20 hottest markets lie in the Northeast, with the Manchester–Nashua, NH, metropolitan area in the No. 1 spot. This hot market mainstay—where listings receive triple the eyeballs as usual and linger a median of just 24 days before getting snapped up—has ranked in the top three every month since February 2021.

Following closely behind is the Midwest, with eight of the hottest markets in September. The Oshkosh–Neenah, WI, area ranked highest for that part of the country, coming in at seventh place.

“The Northeast and Midwest have dominated the hottest markets list since early 2022,” notes Jones. “The Midwest and Northeast have gained in popularity due to their affordability.”