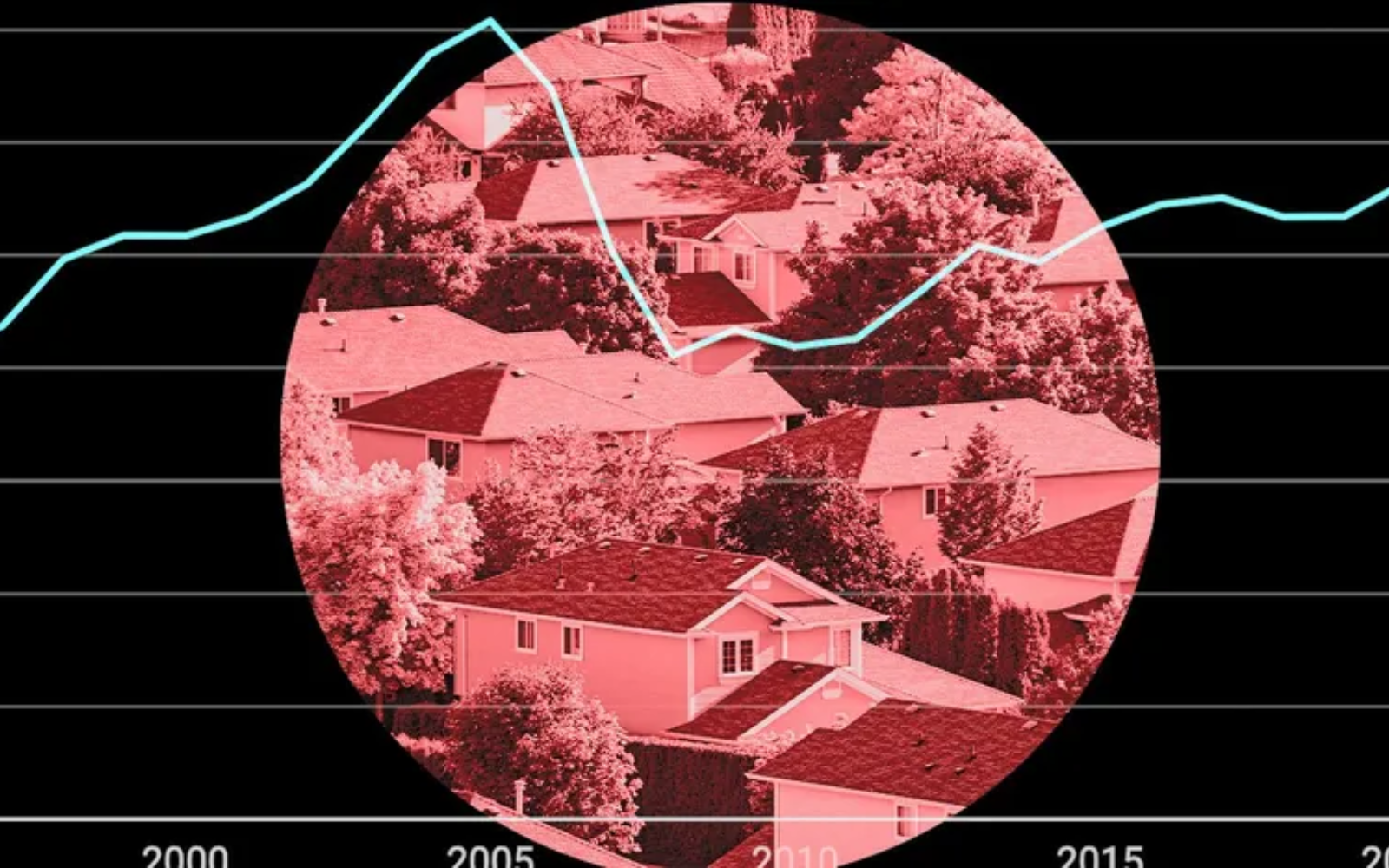

The Number of Homeowners Facing Foreclosure Is Falling—but Likely To Rise in 2024

By Clare Trapasso | REALTOR.COM

As 2023 comes to an end, fewer homeowners are facing foreclosure than they were earlier this year.

The number of homeowners with a foreclosure filing fell 7% in November from the previous month, according to a recent report from real estate data firm ATTOM. But real estate experts warned that foreclosures will likely rise in 2024.

“While we’ve observed a modest decrease in U.S. foreclosure activity most likely due to seasonal factors, it’s essential to note that these fluctuations are a part of the cyclical nature of the market,” ATTOM CEO Rob Barber said in a statement.

There were still more than 3,200 properties facing foreclosure in November, up 5% from November 2022. That represented roughly 1 in every 4,347 residential properties with a foreclosure filing in November.

Filings included default notices, scheduled auctions, and bank repossessions.

Most real estate experts don’t expect another foreclosure closure, similar to what washed over the country during the Great Recession. New laws and requirements from lenders eradicated from the market the riskiest mortgages, the ones with payments that ballooned over time, and mortgage applicants are required to be much more qualified to get a loan today.

In addition, there are now more buyers than there are homes for sale—the opposite problem experienced in the 2000s. That’s kept home prices high and few homeowners from going underwater on their loans. So even if homeowners hit some financial turbulence, they should be able to sell their homes without going into foreclosure.

That doesn’t mean, though, that some homeowners won’t lose their homes.

“As we look ahead to 2024, we anticipate a potential uptick in foreclosure activity as various economic factors evolve and market dynamics shift,” Barber said.

Which places had the most foreclosure filings?

Foreclosures were stretched throughout the nation, with homeowners struggling the most in the mid-Atlantic, Ohio, South Carolina, and parts of California.

Homeowners in Delaware had the highest percentage of foreclosure filings in November, with 1 in every 2,393 homes at risk. It was followed by Maryland, with 1 in 2,537; Ohio, with 1 in 2,656; South Carolina, with 1 in 2,711; and New Jersey, with 1 in 2,834.

Bakersfield, CA, was the metropolitan area where homeowners had the most foreclosure filings, with 1 in every 1,595 properties. Next up was Cleveland, with 1 in 1,818; Canton, OH, with 1 in 1,820; Columbia, SC, with 1 in 1,922; and Stockton, CA, with 1 in 1,961. (Only metros with at least 200,000 residents were included in this part of the ATTOM analysis.)

The good news for homeowners is just 2,558 foreclosures were completed nationwide in November. The number of homeowners losing their properties dropped 23% from October and 32% from last year.