The Most Undervalued Housing Markets in the U.S.

By Patrick S. Duffy | US NEWS & WORLD REPORT

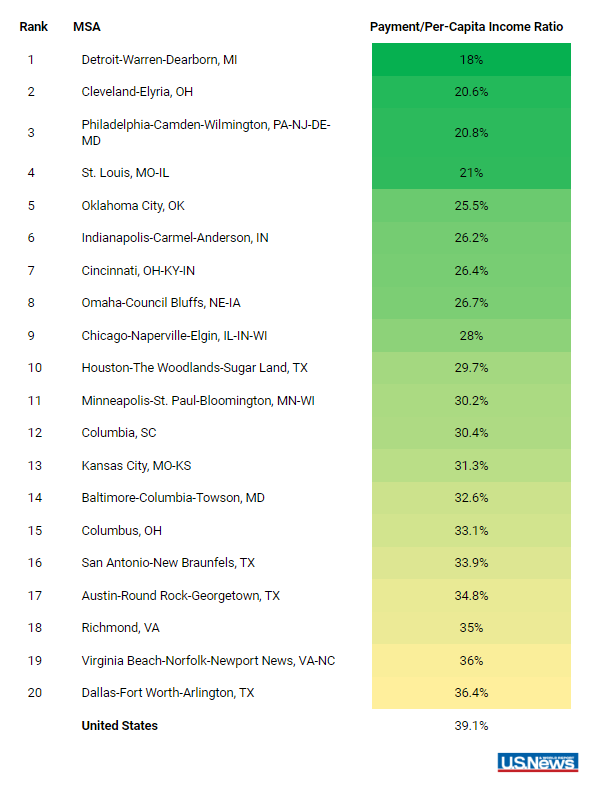

Monthly costs in these locations start as low as 18% of local per capita incomes, compared with the national average of 39%.

Detroit may not be the most undervalued area for long. Its economy will continue to see steady growth in the years ahead with more jobs and higher wages for area residents.

Key Takeaways:

- The most undervalued markets to purchase a home continue to be located predominantly in the Midwest and the East Coast, led by Detroit, Cleveland, Philadelphia, St. Louis and Oklahoma City.

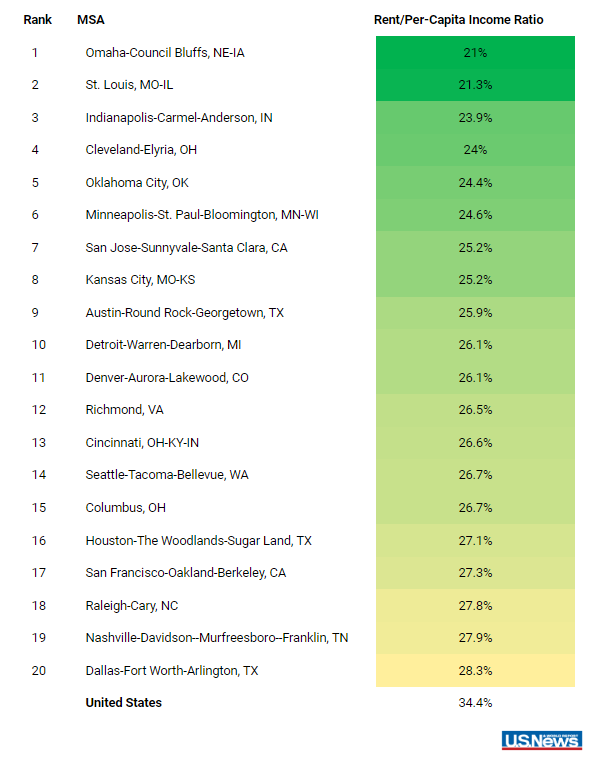

- The most undervalued markets to rent a home are also concentrated in the Midwest, led by Omaha, St. Louis, Indianapolis, Cleveland and Oklahoma City.

- You’ll save the most buying versus renting a home in Detroit, Philadelphia, Cleveland, Chicago and Columbia, South Carolina.

With inflation on the retreat and most real estate experts predicting mortgage rates will also decline in the months ahead, there are plenty of homebuyers and sellers ready to jump back into the housing market. For buyers, a purchase could mean their first leg up on the housing ladder, as well as finding more space and a better location. For sellers, a sale could mean downsizing from a large house, upgrading to a home with more space due to a growing family or even having to sell due to the “three D’s”: death, divorce and debt.

Buyers, in particular, would be most interested in finding a home they consider undervalued for a variety of reasons, such as an up-and-coming location not yet on the radar of real estate agents, a well-designed home in need of some TLC or even a metropolitan statistical area (MSA) suffering through job losses. If they do opt for a home considered overvalued, that could be due to a rare find in a great neighborhood or school district in which they plan to spend many years.

Sometimes, however, undervalued homes are located in a MSA with a healthy job market, plenty of interesting cultural opportunities and other amenities. For our analysis, we’re focusing on those MSAs with home prices and rents below what they should be based on local incomes, which could mean further upsides for homebuyers and investors.

What Does Undervalued Mean?

A general rule from the Department of Housing and Urban Development states that households spending more than 30% of their gross monthly incomes on a place to live are “cost burdened.” This burden has become even more important given the inflation spike U.S consumers have experienced over the last 2.5 years and leaves even less room for spending on other necessities of life, such as food, clothing, transportation and health insurance.

For our rankings of overvalued and undervalued markets, instead of household income we look more closely at local per capita incomes since that’s considered by some to be a better measure of an area’s wealth. Overvalued and undervalued markets are those in which households are respectively paying far more or less on their housing costs compared with the national per capita income.

As these are national figures, these ratios can vary widely between markets, with some homeowners paying up to two-thirds or more of local per capita incomes for principal and interest alone, and renters paying well over half.

Alternatively, some homeowners and renters are paying less than one-quarter of local per capita incomes on principal and interest or rent. As a result, with many homeowners and renters paying much less than the ratio of housing costs to U.S. per capita income, a number of MSAs are undervalued based on local earnings.

How Home Prices Changed During and After the Pandemic

In the pre-pandemic days of late 2019 and early 2020, on a national level the U.S. housing market was still fairly balanced. With a 30-year, fixed-rate mortgage rate of 3.6%, the typical homeowner was paying just 22% of monthly per capita income on mortgage payments. At the same time, the typical tenant was paying a much higher 33% of monthly per capita income in rent, thereby providing a great incentive for them to dive into homeownership.

However, by the end of 2023, while the share of monthly per capita incomes paid by tenants to landlords edged up to 34%, for homeowners it soared to 39%. This rise was mostly due to mortgage rates briefly jumping to nearly 7.8% before gradually falling and recently ranging from 6.6% to 6.9%.

Notably, new markets added to the Housing Market Index since last November include Albuquerque, New Mexico, and two MSAs in Hawaii, including Kahului-Wailuku-Lahaina and urban Honolulu.

For this analysis, monthly housing costs below the national median per capita income for owning (39.1%) or renting (34.4%) indicate an undervalued market. Our data for these rankings are primarily sourced from the U.S. News Housing Market Index, an interactive platform providing a data-driven overview of housing markets nationwide.

These rankings are based on data from November 2023, which is the most recent and comprehensive data from the index. If you’re following various housing markets, check back with the online interface for updates at least once per month. See the methodology here.

Undervalued Homes for Sale

If you’re in the market to purchase a home, the following five MSAs are the most undervalued, with a payment-to-per capita income ratio below 26% and as low as 18%. This ratio is well below the national average of just over 39%:

- Detroit: 18.0%

- Cleveland: 20.6%

- Philadelphia: 20.8%

- St. Louis: 21.0%

- Oklahoma City: 25.5%

Even if former Rust Belt cities such as Detroit, Cleveland, St. Louis and Oklahoma City are again topping the list of the most undervalued markets in which to buy a home, in more recent years some of them have successfully revitalized their economies and attracted new businesses due to relatively low costs of doing business. For the Detroit MSA, the median payment-to-income ratio of 18% is less than half the 39% ratio for the overall U.S.

The Most Undervalued MSA to Buy a Home

The Detroit MSA has a variety of strengths, such as a low unemployment rate, few foreclosures and the country’s lowest mortgage payment-to-per capita income ratio. However, weaknesses include a low ratio of building permits to household growth and a sharp jump in the rental vacancy rate, which more than doubled from 5.2% to 11.4% in the 12 months prior to September 2023.

According to an economic forecast through 2028 by the University of Michigan, Detroit’s economy will continue to see steady growth in the years ahead with more jobs and higher wages for area residents. Although job growth won’t rival fast-growing regions in states such as Texas and Florida, steady growth year after year is still a testament to the city’s economic strategy to diversify and move away from mostly being known as the Motor City.

Detroit may not be the most undervalued area for long, given the MSA had the highest year-over-year price gain through November, according to the widely followed 20-city S&P CoreLogic Case-Shiller Index in a Jan. 30 report.

“Once again, Detroit reported the highest year-over-year gain among the 20 cities with an 8.2% increase in November, followed again by San Diego with an 8% increase,” the report said.

The following is a deeper look at the various data points regularly tracked by the Housing Market Interface for this MSA:

The overall Housing Market Index of 61.1 for the Detroit MSA fell by 2.3 year-over-year through October and is comprised of three subindexes on a 1-100 point scale, with 100 being the healthiest.

- Demand HMI – 53.9

- Supply HMI – 36.9

- Financial – 92.5

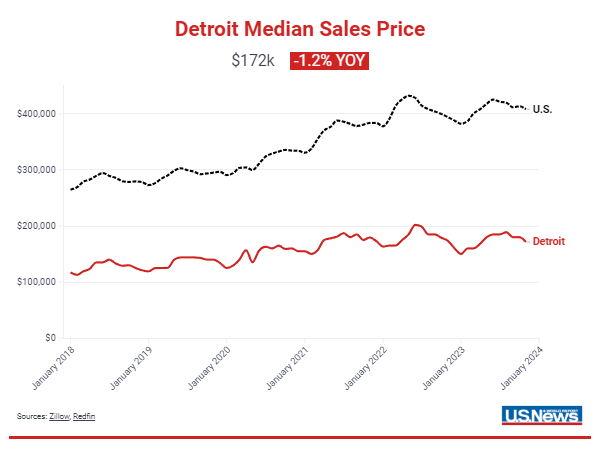

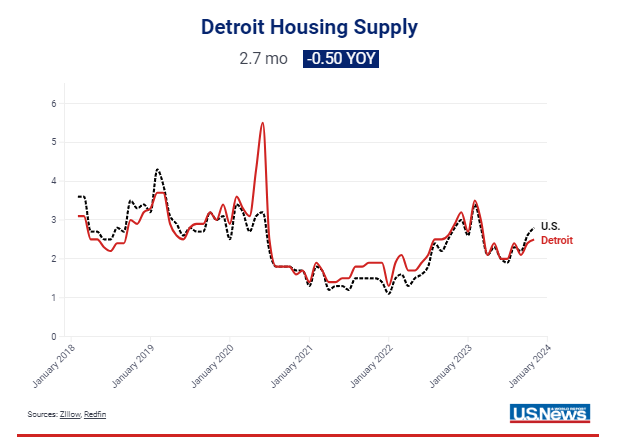

The median price in the Detroit MSA fell 1.2% over the past year to $172,000, which is the lowest among the MSAs currently tracked by the Housing Market Index. Despite falling prices, housing supply has fallen by 0.5 months over the last year to 2.7 months. This level of supply is at least one-half of what is generally considered a balanced housing market.

For now, the rates of mortgage delinquencies in the Detroit area nearly match those at the national level, although these rates could rise if homeowners begin to struggle with higher bills for property taxes and property insurance. However, foreclosures remain at low levels which are also half the national average.

U.S. NEWS

U.S. NEWS

Once totaling over 1,000 and even sometimes 1,500 units per month 20 years ago, single-family detached building permits have ranged from 400 to 600 per month. Looking ahead through the first two months of 2024, they’re forecast to range from 250 to 350 per month.

Permits for multifamily homes, which typically ranged 300 to 400 units per month 20 years ago, plummeted to well under 100 per month in the wake of the financial crisis. In more recent years, multifamily permits have risen to as high as 400 per month, but totals can be volatile from month to month. Peering ahead further into 2024, multifamily permits activity is forecast to hover close to 150 per month.

U.S. NEWS

U.S. NEWS

Undervalued Homes for Rent

If you’re among the growing number of potential buyers waiting to decide on the right time to jump into the housing market, you may live in an MSA with a rent-to-income ratio far below the national median of 34.4%. In terms of undervalued rental housing markets, this list is led again by several markets in the Midwest in which this ratio ranges from about 24% to 26% of local per capita incomes:

- Omaha, Nebraska: 21.0%

- St. Louis: 21.3%

- Indianapolis: 23.9%

- Cleveland: 24.0%

- Oklahoma City: 24.4%

While Detroit is ranked as the 10th most undervalued market for buying a home, the lowest ratios for renting one are found in the greater Omaha (21.0%) and St. Louis (21.3%) areas. Other MSAs with rent-to-per capita income ratios below the national average of 34.4% include the other Midwest regions of Indianapolis, Cleveland and Oklahoma City. Interestingly, San Jose, California, also ranks as a relatively low-cost market for renters due to a high per capita income and a rent-to-per capita income ratio of 25.2%.

The Most Undervalued MSAs to Rent a Home

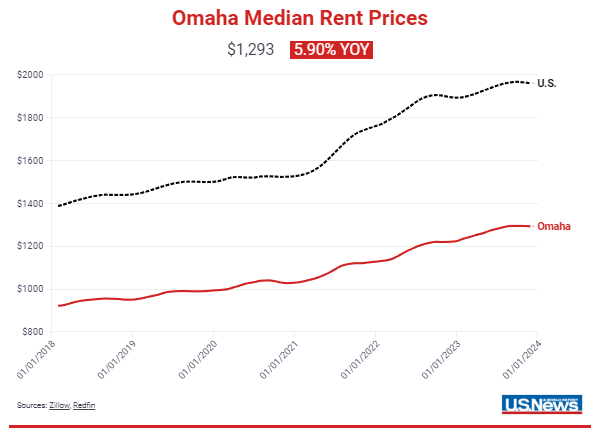

The Omaha MSA is ranked as one of the most undervalued regions to rent a home because its rental rates remain a bargain even after increases over nearly 6% from the past year.

The following is a deeper look at the various data points regularly tracked by the Housing Market Interface for this MSA:

U.S. NEWS

The overall Housing Market Index of 64.1 for the Omaha MSA edged up 2.22 year-over-year through October, with the subindexes ranging from 41.1 to 95.6 on a scale of 1-100:

- Demand HMI – 55.5

- Supply HMI – 41.1

- Financial HMI – 95.6

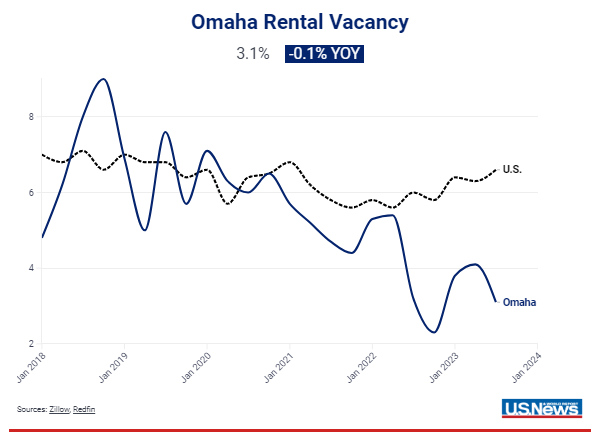

Besides its low payment- and rent-to-income ratios, Omaha’s strengths also include a low rental vacancy rate of just 3.1%, making it potentially attractive to investors. However, some of its weaknesses include housing permits not keeping up with household growth and low housing supply for sale of just 2.0 months.

By November 2023, even though the median observed rent price in the Omaha MSA rose 5.9% year-over-year to $1,293, it was still the lowest rent of the MSAs currently tracked by the Housing Market Index and compares with a median monthly mortgage payment of $1,961.

Owning Vs. Renting

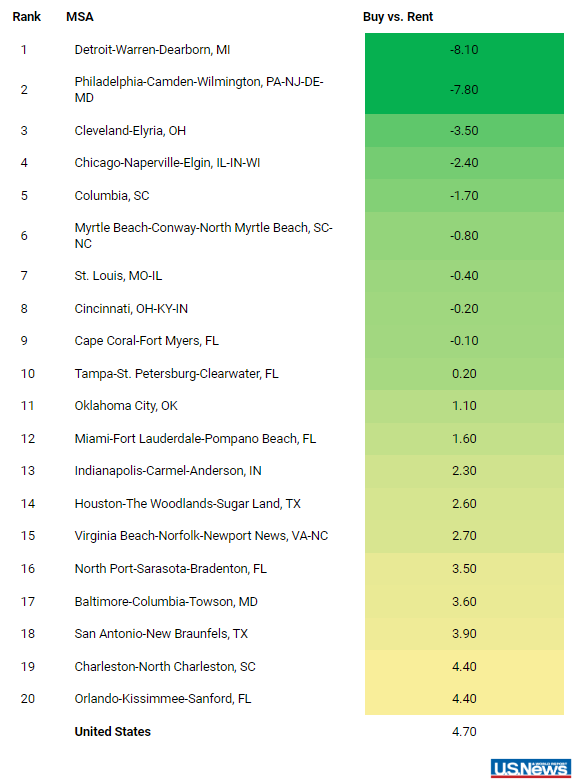

For those potential homebuyers looking for the best time to purchase a home, another metric to study is the difference between the cost of owning versus renting in a particular MSA. Whereas the difference between these ratios at the national level is about 4.7% (and up from just 0.9% a year ago) for the most undervalued market the cost to own can be up to 8% less than renting.

The following five MSAs are markets in which the cost to own is about 2% to 8% less than renting:

- Detroit: -8.1%

- Philadelphia: -7.8%

- Cleveland: -3.5%

- Chicago: -2.4%

- Columbia, South Carolina: -1.7%

Methodology

The U.S. News Housing Market Index is the most comprehensive collection of data points for the country’s largest Metropolitan Statistical Areas also easily available for free on the Internet. This data is sourced from a variety of government and private sources and is referenced by clicking the i button next to an interface heading.

The overall index includes four subindexes:

The Demand HMI includes government data on employment, unemployment, household growth, consumer sentiment from the University of Michigan, median home sales prices from Redfin and observed, smoothed housing rental prices from Zillow.

The Supply HMI includes government data on housing supply, rental vacancy rates, construction costs, construction jobs, builder sentiment from the National Association of Home Builders and architectural billings from the American Institute of Architects.

The Financial HMI includes government data on interest rates and access to credit, delinquencies and foreclosures from Black Knight, and ratios of monthly mortgage and rental payments to per capita incomes calculated by the index. Monthly mortgage payments assume conventional financing with 20% down at the average monthly 30-year fixed rate reported by Freddie Mac.

Per capita income for each MSA was estimated through November 2023 using a proprietary formula incorporating the most recent annual Census Bureau data for July 2022 (and reported in December 2023), monthly national personal income growth from the Bureau of Economic Analysis, and a calculation of each MSA’s relative per capita income growth versus the U.S. for 2020 through 2022.