The Top U.S. Cities Immune to the Housing Market Malaise—Where Price Growth Is Surging

By Margaret Heidenry | realtor.com

The housing market has been stagnant for several years now, with high home prices and unpredictable mortgage rates sidelining buyers and sellers alike.

But some U.S. metros seem to be defying the real estate market malaise. In these places, not only are homes selling at a quicker pace than the rest of the country, but prices are up as well.

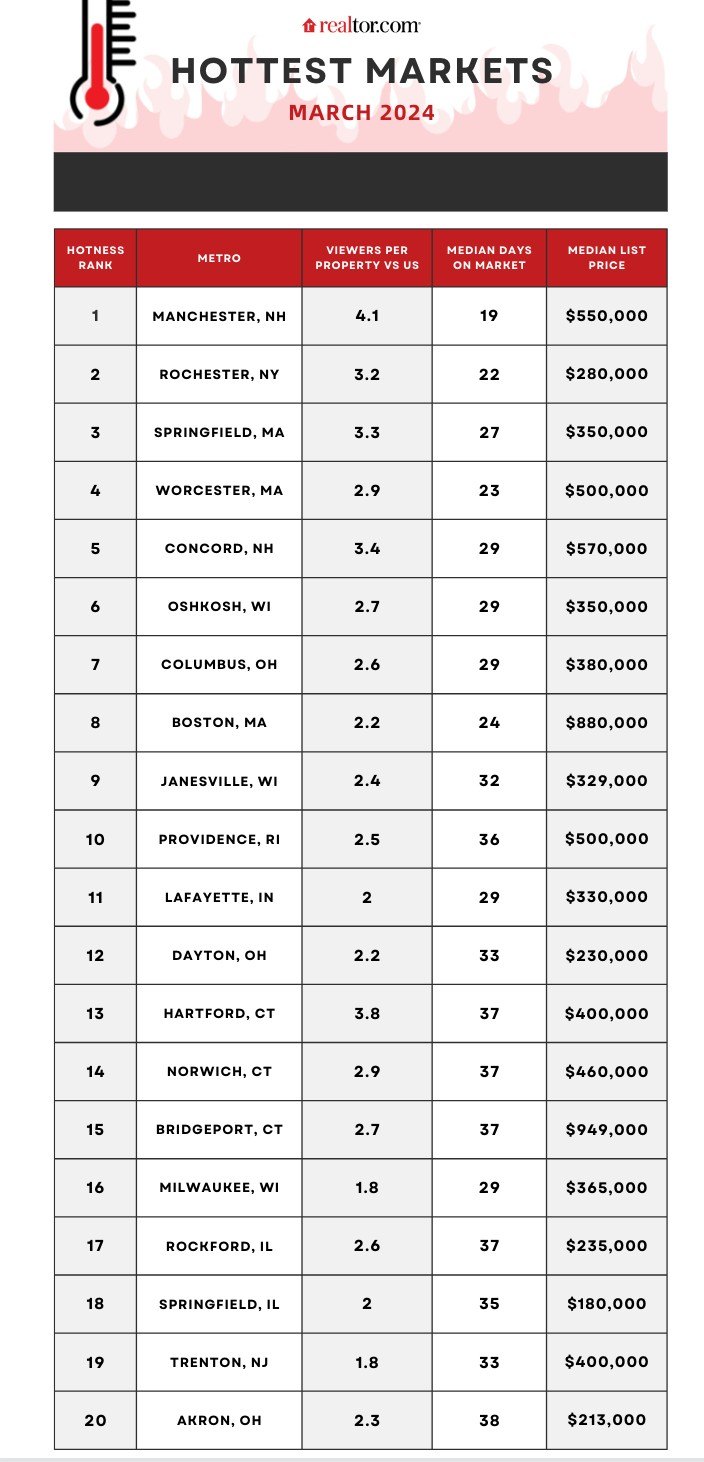

Indeed, in its latest data analysis, which ranks the nation’s 20 hottest markets, Realtor.com® found that home prices are flat everywhere, seeing only a 2% rise in March—except for the hottest markets, which rose by 5.3% annually.

“Prices increased slightly nationwide in March, but the month’s hottest markets saw more substantial price growth due to high demand,” says Realtor.com economic analyst Hannah Jones.

The Northeast and the Midwest swept March in terms of housing market heat, capturing 13 and seven metros, respectively.

The Manchester-Nashua, NH, metro area continued its long-running reign, claiming the top spot for the seventh time in the past year. It was followed by Rochester, NY, and Springfield, MA. (To uncover these hot markets, we measure the number of unique views per property on Realtor.com and the number of days a listing remains active on the site.)

Buyers hoping to purchase a home in one of these desirable cities might be discouraged by the rise in price growth. But, Jones points out, the overall demand for these markets is shrinking.

“Though hot market price growth continues to outpace U.S. price growth, the difference has narrowed, and the average hot market price growth has slowed,” Jones explains in her analysis. “Since last summer, price growth has cooled in the country’s hottest markets.”

The 7 hot markets cooling off pricewise

Buyers looking for a drop in median listing price have seven metros out of the 20 hottest markets to check out this spring homebuying season.

Bridgeport-Stamford, CT, No. 15, is the top area with a dip in median prices in March compared with a year earlier, sinking 13.6% to a median of a still-pricey $949,000. Nearby Norwich-New London, CT, No. 14, followed with the median listing price decline of 9.6%, to $500,000.

Runners-up include Oshkosh-Neenah, WS, No. 6, where home prices fell 6.4% to $350,000, and Providence-Warwick, RI, No. 10, which saw prices decline by 2.8% to an average of $500,000.

The other three metros that saw relaxed prices are Hartford, CT (-0.7%), Janesville, WI (-0.4%), and Milwaukee, WI (-0.3%)

Why are prices coming down in the hottest markets? In some instances, it’s because homes with less square footage are hitting the market.

“Some of the price decline in these areas is due to more smaller homes available,” explains Jones. “Bridgeport and Providence did see price per square foot fall 5.1% and 1.8%, respectively. Moreover, Bridgeport and Norwich were the only markets in the top 20 that saw price per square foot fall annually in March.”

But with mortgage rates now over 7% and home affordability headwinds continuing to blow strongly, any drop in homebuying costs is welcome news for buyers.

The South and West are decidedly not hot

The Midwest and Northeast metros continue to eclipse the South and West on the Realtor.com list of the hottest markets, with the latter areas not appearing on the list for the past six months.

The once red-hot South holds the distinction as the area with the most metros—4 out of 5—that have slipped the furthest.

Tied for the furthest fall of 149 spots are North Port-Sarasota-Bradenton, FL, and Dothan, AL. Punta Gorda, FL, and Cape Coral-Ft. Myers, FL, follow with a tie for dropping 133 spots.

“Sun Belt metros picked up steam during the [COVID-19] pandemic, but climbing prices and mortgage rates eventually stifled buyer demand,” Jones explains. “More affordable markets in the Midwest and Northeast grew in popularity as once-frenzied Southern markets cooled off.”

In a nutshell, it’s a good thing for buyers that the South and West are taking an extended break from their time dominating the hottest markets list.